Ethereum Price Prediction: Navigating the Path to $5,000 Amid Whale Volatility and Technical Breakouts

#ETH

- Technical indicators show ETH testing crucial resistance at $4,700 with MACD still in negative territory but price holding above 20-day MA

- Mixed fundamental signals with positive ETF demand and protocol upgrades offset by significant whale selling pressure creating volatility

- Path to $5,000 remains plausible but requires breakthrough above $4,700 resistance and sustained institutional interest

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Resistance

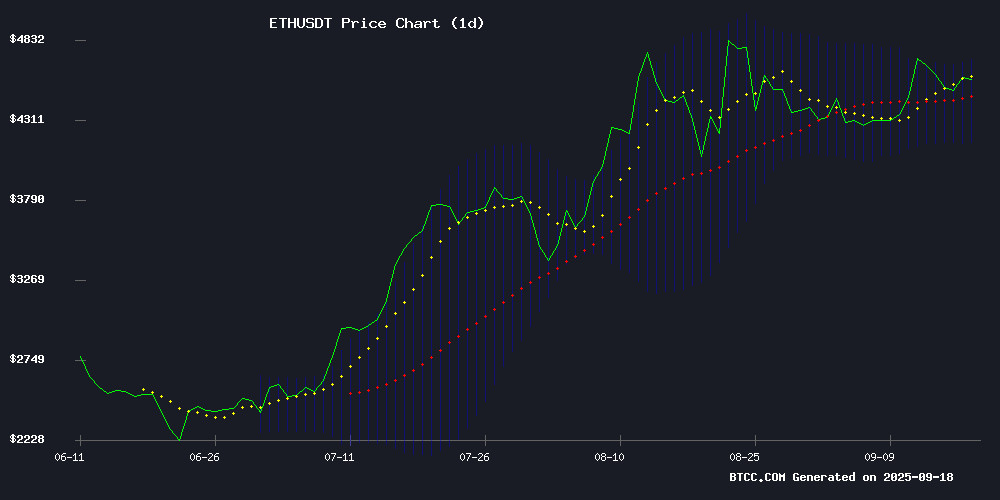

Ethereum is currently trading at $4,613.51, hovering just above its 20-day moving average of $4,433.91. The MACD indicator remains negative at -69.82, suggesting some bearish momentum, though the price sits comfortably within the Bollinger Band range between $4,159.09 and $4,708.72. According to BTCC financial analyst Michael, 'ETH is testing crucial resistance around the $4,700 level. A sustained break above could trigger momentum toward the $5,000 psychological barrier, while failure may see a retest of the $4,400 support zone.'

Market Sentiment: Bullish Fundamentals Face Whale Pressure

Recent news flow presents a mixed picture for Ethereum. Positive developments include the AAVE V4 roadmap integration with ERC-4626 and growing ETF demand creating record staking queues. However, significant whale activity has introduced volatility, with 90,000 ETH recently sold off. BTCC financial analyst Michael notes, 'The fundamental outlook remains constructive with institutional adoption through ETF products and protocol upgrades, but traders should monitor whale movements closely as large transactions can cause short-term disruptions despite the bullish structural narrative.'

Factors Influencing ETH's Price

Ethereum's Rally Loses Steam as Trading Volumes Flatten

Ethereum's three-month surge, which saw prices climb nearly 80% since mid-June, is showing signs of fatigue. Binance data reveals a neutralization in both spot and perpetual trading activity—a potential warning for bulls despite ETH's year-to-date outperformance.

The Z-score for ETH spot versus perpetual volumes has oscillated between 0.0 and -1.0 throughout September 2025, indicating balanced participation without clear dominance from either leveraged traders or spot investors. This equilibrium marks a departure from the speculative frenzy that typically accompanies major crypto rallies.

Perpetual contracts, often the engine behind volatile price swings, are notably losing influence. The decoupling between price action and derivatives activity suggests the market may be entering a consolidation phase after ETH's ascent from $2,127 to over $4,500.

Aave V4 Roadmap Signals Strategic Shift with ERC-4626 Integration and Layer-2 Pullback

Aave Labs has unveiled its roadmap for V4, targeting a Q4 mainnet launch with architectural upgrades that mark a departure from multichain expansion. The update replaces aTokens' rebasing mechanics with ERC-4626 vault-standard accounting, streamlining tax reporting and DeFi interoperability while reducing reliance on underperforming layer-2 networks.

The protocol's shift to share-based yield tracking eliminates rebasing confusion for portfolio tools and auditors. ERC-4626's price-per-share model offers predictable behavior for developers, contrasting with V3's balance-inflation approach that complicated integrations.

Aave's technical documents confirm optional tokenization via ERC-4626 vaults, abandoning exchange rate calculations in favor of transparent share accounting. This overhaul aims to cement Aave's position as DeFi's most reliable money market amid growing institutional scrutiny of blockchain accounting practices.

Ethereum Correction Phase Nears End as Binance Data Hints at Recovery

Ethereum's recent correction phase, following its late-August peak near $4,950, may be approaching its conclusion. Binance futures market data suggests a potential reversal, with open interest (OI) declines historically preceding spot market recoveries.

Crypto researcher Burak Kesmeci identifies a pattern where hourly OI drops averaging 14.9% correlate with 10.7% price corrections. Notable instances include August 17's 10.52% OI decline, August 20's 25.38% plunge, and September 13's 8.69% reduction—each foreshadowing spot market weakness.

The market may require OI to cool further to approximately 9.69 billion for a full reset. Such leverage unwinding often sets the stage for renewed bullish momentum, as traders flush out excess speculation.

Ethereum Whales Trigger Volatility with 90,000 ETH Sell-Off

Ethereum faces mounting pressure as large holders offloaded 90,000 ETH within 48 hours, fueling concerns of heightened volatility and potential price corrections. The sell-off occurred just as ETH struggled to breach key resistance levels, leaving traders uncertain about its near-term trajectory.

On-chain analytics reveal coordinated selling by wallets holding 1,000-10,000 ETH, historically a precursor to trend reversals. Analyst Ali notes this activity coincides with deteriorating price momentum—a bearish confluence that often precedes broader market pullbacks.

Currently trading near $4,457, Ethereum has repeatedly failed to conquer the $4,700-$4,800 resistance zone. Immediate support rests at $4,350, but sustained whale selling could test lower levels. Such large-scale disposals frequently trigger retail investor panic, exacerbating downward pressure during critical technical junctures.

Ethereum Eyes $5,000 as Bullish Cross Meets FED Rate Cut Speculation

Ethereum's price hovers near $4,500 as traders brace for potential volatility ahead of the Federal Open Market Committee meeting. A bullish technical pattern—the 50-day moving average crossing above the 200-day average—hints at further gains, with historical precedents suggesting short-term rallies. ETH surged 60% in July and 24% in August following similar signals.

Institutional activity adds complexity. BlackRock sold 4,489 ETH on September 17, contrasting with broader optimism fueled by Ethereum 2.0's scalability upgrades. Market sentiment remains bifurcated: technical traders anticipate a push toward $5,000, while macro observers await the Fed's next move.

Ethereum Price Prediction: Dip Likely as Massive Whale Dump Precedes Fed Rate Cut

Ethereum faces downward pressure as whales offloaded 90,000 ETH worth nearly $500 million in 48 hours, signaling potential profit-taking or portfolio rebalancing. The sell-off coincides with spot Ether ETF outflows and Citigroup's bearish year-end forecast, casting doubt on immediate bullish momentum.

Despite trading below $4,500, analysts maintain Ethereum could rebound if it holds above $4,400. Market participants now weigh whale activity against macroeconomic catalysts, including the anticipated Fed rate cut that some believe may reignite upward movement.

Ethereum Staking Queues Hit Record Delays Amid ETF Demand and Security Concerns

Ethereum's staking ecosystem faces unprecedented congestion, with 2.5 million ETH ($11.25 billion) languishing in withdrawal queues. Validator exit times have ballooned to 46 days—more than double August's peak—as profit-taking, restaking strategies, and spot ETF preparations collide with infrastructure limitations.

The backlog intensified after Kiln's precautionary withdrawal of 1.6 million ETH following the NPM and SwissBorg security breaches. Market participants now navigate a perfect storm: institutional demand for upcoming ETH ETFs, regulatory clarity from the SEC, and the compounding effects of liquid restaking protocols.

Analysts interpret the congestion as growing pains rather than systemic risk. "Queue lengths reflect maturation," says Thalman of Delphi Digital. "We're seeing Ethereum's proof-of-stake model stress-tested by competing forces—capital rotation, yield optimization, and compliance workflows."

Ethereum Targets 77% Rally as Pullback Ends, Bulls Eye Breakout

Ethereum (ETH) is regaining momentum after a corrective phase, with analysts eyeing a potential 77% surge if key resistance levels are breached. The cryptocurrency recently tested its $4,811 target before consolidating—a typical pattern in bullish cycles that resets indicators for further upside.

Javon Marks, a prominent crypto analyst, notes ETH has stabilized near critical support zones, signaling strong buyer interest. A decisive break above $4,811 could catalyze a rally toward $8,557, reinforcing Ethereum's bullish trajectory.

Ethereum Treasury Firm The Ether Machine Files to Go Public via SPAC Merger

The Ether Machine, an institutional-grade Ethereum treasury management firm, has filed a draft registration statement with the SEC to go public through a merger with Nasdaq-listed SPAC Dynamix Corporation (ETHM). The move solidifies its position as a major corporate holder of ETH, with 495,362 tokens worth $2.1 billion as of September 2025—making it the third-largest public Ethereum treasury after Bitmine Immersion Tech and SharpLink Gaming.

Co-founder Andrew Keys anchored the treasury with a $741 million ETH contribution, while strategic institutional funding has brought total backing to over $800 million. The firm continues aggressive accumulation, adding 150,000 ETH in August alone—a bullish signal for Ethereum's institutional adoption as both an asset and financial infrastructure.

How High Will ETH Price Go?

Based on current technical patterns and market fundamentals, Ethereum appears positioned for a potential rally toward the $5,000 level. The convergence of technical indicators showing strength above the 20-day MA, combined with fundamental catalysts including ETF demand and protocol upgrades, creates a favorable environment. However, traders should remain cautious of whale-induced volatility and monitor key resistance at $4,700. A successful break above this level could accelerate momentum toward $5,000, while failure might result in consolidation between $4,200-$4,600.

| Price Level | Significance | Probability |

|---|---|---|

| $4,700 | Key Resistance | Breakout needed for upward momentum |

| $5,000 | Psychological Target | Achievable with sustained bullish momentum |

| $4,400 | Support Level | Critical for maintaining bullish structure |